Day count conventions: Difference between revisions

imported>Doug Williamson (Capitalise 'US'.) |

imported>Doug Williamson (Update for LIBOR transition.) |

||

| (40 intermediate revisions by the same user not shown) | |||

| Line 1: | Line 1: | ||

The day count convention determines how interest accrues over time in a variety of transactions, including bonds, swaps, bills and loans. | The day count convention determines how interest accrues over time in a variety of transactions, including bonds, swaps, bills and loans. | ||

In wholesale markets, interest is usually expressed to accrue at a rate per annum (the reference period). | |||

It is often due and payable at shorter intervals, usually a number of months (the interest period). | |||

The day count convention regulates how the parties are to calculate the amount of interest payable at the end of each interest or other period. It is commonly expressed as a fraction. The numerator will be the convention for the number of days in the period - usually actual or a notional 30. The denominator is the convention for the number of days in the reference period - often 360 or 365. | |||

The day count (or 'daycount') convention regulates how the parties are to calculate the amount of interest payable at the end of each interest or other period. | |||

It is commonly expressed as a fraction. | |||

The [[numerator]] will be the convention for the number of days in the period - usually actual or a notional 30. | |||

The [[denominator]] is the convention for the number of days in the reference period - often 360 or 365. | |||

Conventions vary depending on the market type, location and the currency in question. For example, euro-denominated bonds are usually calculated on an actual/actual basis, while fixed rate non-euro denominated bonds are often calculated on a 30/360 basis. The London interbank market, on the other hand, operates on the basis of actual/360, except where the currency is sterling, for which the London interbank convention is actual/365. | Conventions vary depending on the market type, location and the currency in question. | ||

For example, euro-denominated bonds are usually calculated on an actual/actual basis, while fixed rate non-euro denominated bonds are often calculated on a 30/360 basis. | |||

The London interbank market, on the other hand, operates on the basis of actual/360, except where the currency is sterling, for which the London interbank convention is actual/365 fixed. | |||

Commonly used day count conventions are considered below, but first it is important to bear in mind the various business day conventions that may apply. These regulate the start and end date of each period. | Commonly used day count conventions are considered below, but first it is important to bear in mind the various business day conventions that may apply. These regulate the start and end date of each period. | ||

| Line 9: | Line 27: | ||

==Business day conventions== | ==Business day conventions== | ||

===No date adjustment=== | ====No date adjustment==== | ||

Cycle dates are not adjusted for weekends or holidays and are forced to land within a cycle month. | Cycle dates are not adjusted for weekends or holidays and are forced to land within a cycle month. | ||

===Following business day/next good business day=== | ====Following business day/next good business day==== | ||

Dates are adjusted for weekends and holidays to the next good business day. | Dates are adjusted for weekends and holidays to the next good business day. | ||

===Preceding/previous good business day=== | ====Preceding/previous good business day==== | ||

Dates are adjusted for weekends and holidays to the previous good business day. | Dates are adjusted for weekends and holidays to the previous good business day. | ||

===Modified following/modified business day=== | ====Modified following/modified business day==== | ||

Dates are adjusted to the next good business day unless that day falls in the next calendar month in which case the date is adjusted to the previous good business day. | Dates are adjusted to the next good business day unless that day falls in the next calendar month in which case the date is adjusted to the previous good business day. | ||

===End of month – no adjustment=== | ====End of month – no adjustment==== | ||

Dates are adjusted to land on last day of the month. | Dates are adjusted to land on last day of the month. | ||

===End of month – previous good business day=== | ====End of month – previous good business day==== | ||

Dates are adjusted to the last day of the month but if that day is a weekend or holiday, then it is adjusted backward to the previous good business day. | Dates are adjusted to the last day of the month but if that day is a weekend or holiday, then it is adjusted backward to the previous good business day. | ||

===Two business days prior to third Wednesday of month=== | ====Two business days prior to third Wednesday of month==== | ||

Dates generated are two business days prior to the third Wednesday of the month (used in conjunction with Eurodollar futures). | Dates generated are two business days prior to the third Wednesday of the month (used in conjunction with Eurodollar futures). | ||

===Deposit rollover method=== | ====Deposit rollover method==== | ||

Each date is set so it occurs on the same day of the month as the previous date. Each date is set to the next good business day but no | Each date is set so it occurs on the same day of the month as the previous date. Each date is set to the next good business day but no | ||

dates may be adjusted past the last good business day of the month. | dates may be adjusted past the last good business day of the month. | ||

| Line 38: | Line 56: | ||

Interest is calculated as the principal times the interest rate times the day-count fraction, where the day-count fraction is defined by the day-count convention associated with the interest rate. | Interest is calculated as the principal times the interest rate times the day-count fraction, where the day-count fraction is defined by the day-count convention associated with the interest rate. | ||

===Money market basis (actual/360)=== | ====Money market basis (actual/360)==== | ||

This basis is commonly used for | This basis is commonly used for Eurocurrency rates, except sterling. | ||

The day count fraction is defined as the actual number of days in the period over 360. | |||

===Actual/365 | ====Actual/365 fixed==== | ||

This basis is commonly used for | This basis is commonly used for sterling interest rates. | ||

===Eurobond basis (30E/360)=== | The day count fraction is defined as the actual number of days in the period over 365. | ||

30E/360 is used for calculating accrued interest on some legacy currency pre Euro Eurobonds and on bonds in Sweden and Switzerland. This method assumes that all months have 30 days, even February, and that a year is 360 days. Effectively if the start date d1 is 31 then it changes to 30, and if the second date d2 is 31 it too changes to 30. The day count fraction is defined as the number of days in the period (Δ<sub>360</sub>) over where (Δ<sub>360</sub>) is calculated as if every month had 30 days, as described in Figure 1. | |||

It is also used for money markets in Australia, Canada and New Zealand. | |||

This basis is sometimes confused with actual/365, which is defined next. | |||

====Actual/365 or actual/actual==== | |||

This basis is commonly used for all sterling bonds, Euro denominated bonds, US Treasury bonds and for some USD interest rate swaps. | |||

In this case, the day-count fraction is the number of days in the period in a normal year over 365 or the number of days in the period in a leap year over 366. | |||

====Eurobond basis (30E/360)==== | |||

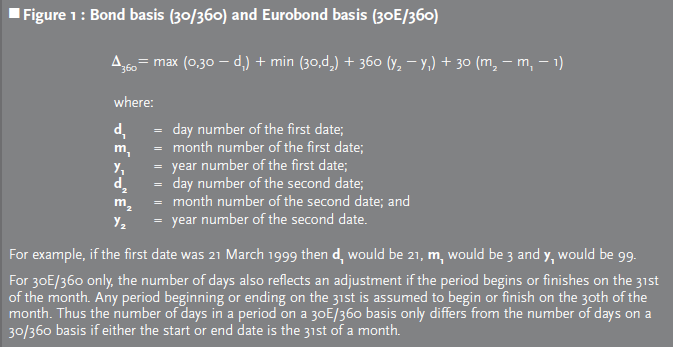

30E/360 is used for calculating accrued interest on some legacy currency pre Euro Eurobonds and on bonds in Sweden and Switzerland. | |||

This method assumes that all months have 30 days, even February, and that a year is 360 days. Effectively if the start date d1 is 31 then it changes to 30, and if the second date d2 is 31 it too changes to 30. | |||

The day count fraction is defined as the number of days in the period (Δ<sub>360</sub>) over where (Δ<sub>360</sub>) is calculated as if every month had 30 days, as described in Figure 1. | |||

[[File:Day count conventions figure 1.png||Bond basis (30/360) and Eurobond basis (30E/360)]] | [[File:Day count conventions figure 1.png||Bond basis (30/360) and Eurobond basis (30E/360)]] | ||

===Bond basis=== | ====Bond basis==== | ||

This basis is used for calculating accrued interest on domestic US bonds (e.g. Yankee bonds, federal agencies, corporate and municipal bonds) | This basis is used for calculating accrued interest on domestic US bonds (e.g. Yankee bonds, federal agencies, corporate and municipal bonds). | ||

===Floating rate notes=== | Each month is assumed to have 30 days, with an exception that if the last day is the 31st and the first day is not 30th or 31st then that month has 31 days. | ||

So the rule is if d1 is 31 it changes to 30, and if d2 is 31 change it to 30 but only if d1 is either 30 or 31. | |||

====Floating rate notes==== | |||

FRNs always use actual/360 or 365 in the case of sterling. | FRNs always use actual/360 or 365 in the case of sterling. | ||

===Fixed coupon=== | ====Fixed coupon==== | ||

This basis is commonly used for Eurobonds, and the | This basis is commonly used for Eurobonds, and the day count fraction is just one divided by the number of interest payments per year. Thus the coupon payments are always the same and any small difference in the number of days between successive coupon payments is ignored. | ||

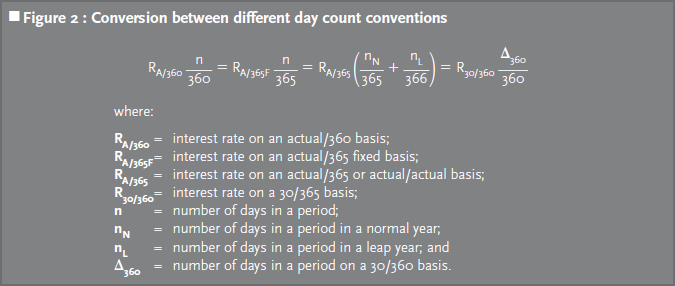

===Conversion between different day count conventions=== | ====Conversion between different day count conventions==== | ||

[[File:Day count conventions figure 2.png||Conversion between different day count conventions]] | [[File:Day count conventions figure 2.png||Conversion between different day count conventions]] | ||

| Line 68: | Line 103: | ||

==Compounding conventions== | ==Compounding conventions== | ||

===Simple | ====Simple interest==== | ||

Simple | Simple interest does not offer the opportunity to earn interest on interest, ie, there is no compounding of | ||

interest | interest. | ||

Simple interest is typically used for instruments with a maturity of less than one year. | |||

Discount factor (DF) = 1 / ( 1 + (R x days / year) ) | |||

: | |||

Where: | |||

:'''R''' = simple interest rate on an actual/365 or actual/360 fixed basis | |||

:'''days''' = number of days in period | |||

:'''year''' = number of days in a conventional year (365 or 360) | |||

===Compound interest=== | ====Compound interest for multiple periods==== | ||

Offers the opportunity for interest payments to be reinvested in order to earn interest on interest. Compound interest is typically used for instruments greater than one year. | Offers the opportunity for interest payments to be reinvested in order to earn interest on interest. Compound interest is typically used for instruments greater than one year. | ||

Discount factor (DF) = 1 / (1 + r)<sup>n</sup> | |||

where: | where: | ||

:''' | :'''r''' = periodic interest rate (r = R x days / year) | ||

:'''n''' = total number of compounding periods | |||

:''' | |||

===Continuous compounding=== | ====Continuous compounding==== | ||

Compounding can be taken to an extreme in which the interest is continuously compounded | Compounding can be taken to an extreme in which the interest is continuously compounded. Continuously compounded rates are rarely quoted in practice for outright deposits or borrowings, although they are used extensively in valuing options. | ||

Discount factor (DF) = e<sup>-Rt</sup> | |||

where: | where: | ||

:'''R''' = continuously compounded interest rate; | :'''R''' = continuously compounded interest rate per year; | ||

:'''t''' = number of years to maturity; and | :'''t''' = number of years to maturity; and | ||

:'''e''' = 2.71828 (to five decimal places). | :'''e''' = 2.71828 (to five decimal places). | ||

== | ==Settlement day conventions== | ||

The settlement day is the day on which traded bonds or securities actually change ownership and are paid for. This is often a few business days after the transaction date, T. Interest rate calculations normally start on the settlement day. | |||

Settlement in Euro denominated bonds and in most markets is on T+3, although for US and UK government bonds and bills it is T+1, and for sterling bonds it is T+5. | |||

==See also== | ==See also== | ||

* [[Bond equivalent yield]] | |||

* [[Compound interest]] | |||

* [[Conventional year]] | |||

* [[Day count]] | * [[Day count]] | ||

* [[ | * [[Effective annual rate]] | ||

* [[ | * [[Leap year]] | ||

* [[ | * [[Money market yield]] | ||

* [[Nominal annual rate]] | |||

* [[Periodic discount rate]] | |||

* [[Periodic yield]] | |||

* [[Simple interest]] | |||

* [[Wholesale]] | |||

== Student article == | |||

[[Media:2016_02_Feb_-_Many_happy_returns.pdf| Happy returns - different conventions, different interest amounts]] | |||

[[Category:Long_term_funding]] | [[Category:Long_term_funding]] | ||

[[Category:Cash_management]] | [[Category:Cash_management]] | ||

Latest revision as of 16:57, 14 April 2022

The day count convention determines how interest accrues over time in a variety of transactions, including bonds, swaps, bills and loans.

In wholesale markets, interest is usually expressed to accrue at a rate per annum (the reference period).

It is often due and payable at shorter intervals, usually a number of months (the interest period).

The day count (or 'daycount') convention regulates how the parties are to calculate the amount of interest payable at the end of each interest or other period.

It is commonly expressed as a fraction.

The numerator will be the convention for the number of days in the period - usually actual or a notional 30.

The denominator is the convention for the number of days in the reference period - often 360 or 365.

Conventions vary depending on the market type, location and the currency in question.

For example, euro-denominated bonds are usually calculated on an actual/actual basis, while fixed rate non-euro denominated bonds are often calculated on a 30/360 basis.

The London interbank market, on the other hand, operates on the basis of actual/360, except where the currency is sterling, for which the London interbank convention is actual/365 fixed.

Commonly used day count conventions are considered below, but first it is important to bear in mind the various business day conventions that may apply. These regulate the start and end date of each period.

Business day conventions

No date adjustment

Cycle dates are not adjusted for weekends or holidays and are forced to land within a cycle month.

Following business day/next good business day

Dates are adjusted for weekends and holidays to the next good business day.

Preceding/previous good business day

Dates are adjusted for weekends and holidays to the previous good business day.

Modified following/modified business day

Dates are adjusted to the next good business day unless that day falls in the next calendar month in which case the date is adjusted to the previous good business day.

End of month – no adjustment

Dates are adjusted to land on last day of the month.

End of month – previous good business day

Dates are adjusted to the last day of the month but if that day is a weekend or holiday, then it is adjusted backward to the previous good business day.

Two business days prior to third Wednesday of month

Dates generated are two business days prior to the third Wednesday of the month (used in conjunction with Eurodollar futures).

Deposit rollover method

Each date is set so it occurs on the same day of the month as the previous date. Each date is set to the next good business day but no dates may be adjusted past the last good business day of the month.

Day count conventions and conversions

Interest is calculated as the principal times the interest rate times the day-count fraction, where the day-count fraction is defined by the day-count convention associated with the interest rate.

Money market basis (actual/360)

This basis is commonly used for Eurocurrency rates, except sterling.

The day count fraction is defined as the actual number of days in the period over 360.

Actual/365 fixed

This basis is commonly used for sterling interest rates.

The day count fraction is defined as the actual number of days in the period over 365.

It is also used for money markets in Australia, Canada and New Zealand.

This basis is sometimes confused with actual/365, which is defined next.

Actual/365 or actual/actual

This basis is commonly used for all sterling bonds, Euro denominated bonds, US Treasury bonds and for some USD interest rate swaps.

In this case, the day-count fraction is the number of days in the period in a normal year over 365 or the number of days in the period in a leap year over 366.

Eurobond basis (30E/360)

30E/360 is used for calculating accrued interest on some legacy currency pre Euro Eurobonds and on bonds in Sweden and Switzerland.

This method assumes that all months have 30 days, even February, and that a year is 360 days. Effectively if the start date d1 is 31 then it changes to 30, and if the second date d2 is 31 it too changes to 30.

The day count fraction is defined as the number of days in the period (Δ360) over where (Δ360) is calculated as if every month had 30 days, as described in Figure 1.

Bond basis

This basis is used for calculating accrued interest on domestic US bonds (e.g. Yankee bonds, federal agencies, corporate and municipal bonds).

Each month is assumed to have 30 days, with an exception that if the last day is the 31st and the first day is not 30th or 31st then that month has 31 days.

So the rule is if d1 is 31 it changes to 30, and if d2 is 31 change it to 30 but only if d1 is either 30 or 31.

Floating rate notes

FRNs always use actual/360 or 365 in the case of sterling.

Fixed coupon

This basis is commonly used for Eurobonds, and the day count fraction is just one divided by the number of interest payments per year. Thus the coupon payments are always the same and any small difference in the number of days between successive coupon payments is ignored.

Conversion between different day count conventions

Compounding conventions

Simple interest

Simple interest does not offer the opportunity to earn interest on interest, ie, there is no compounding of interest.

Simple interest is typically used for instruments with a maturity of less than one year.

Discount factor (DF) = 1 / ( 1 + (R x days / year) )

Where:

- R = simple interest rate on an actual/365 or actual/360 fixed basis

- days = number of days in period

- year = number of days in a conventional year (365 or 360)

Compound interest for multiple periods

Offers the opportunity for interest payments to be reinvested in order to earn interest on interest. Compound interest is typically used for instruments greater than one year.

Discount factor (DF) = 1 / (1 + r)n

where:

- r = periodic interest rate (r = R x days / year)

- n = total number of compounding periods

Continuous compounding

Compounding can be taken to an extreme in which the interest is continuously compounded. Continuously compounded rates are rarely quoted in practice for outright deposits or borrowings, although they are used extensively in valuing options.

Discount factor (DF) = e-Rt

where:

- R = continuously compounded interest rate per year;

- t = number of years to maturity; and

- e = 2.71828 (to five decimal places).

Settlement day conventions

The settlement day is the day on which traded bonds or securities actually change ownership and are paid for. This is often a few business days after the transaction date, T. Interest rate calculations normally start on the settlement day.

Settlement in Euro denominated bonds and in most markets is on T+3, although for US and UK government bonds and bills it is T+1, and for sterling bonds it is T+5.

See also

- Bond equivalent yield

- Compound interest

- Conventional year

- Day count

- Effective annual rate

- Leap year

- Money market yield

- Nominal annual rate

- Periodic discount rate

- Periodic yield

- Simple interest

- Wholesale

Student article

Happy returns - different conventions, different interest amounts